This is Part 5 of our 6-part Deep Dive series on neuromorphic computing—the brain-inspired processors achieving 1,000× efficiency improvements over GPUs at the edge.

← Part 4: The ANYmal Proof | Series Index | Part 6: The Software Problem →

[🧠] Sapien Fusion Deep Dive Series | February 4, 2026 | Reading time: 5 minutes

Why Mercedes-Benz and BMW Went All-In

When Mercedes-Benz announced neuromorphic processor integration targeting 0.1-millisecond pedestrian detection latency, the automotive industry dismissed it as experimental technology too immature for production vehicles. When BMW followed with similar commitments months later, the narrative shifted. Two leading manufacturers don’t simultaneously bet on immature technology. They bet on paradigm shifts they’ve validated internally.

The automotive industry’s embrace of neuromorphic computing signals an inflection point. This technology isn’t emerging—it’s arriving.

The Safety Imperative

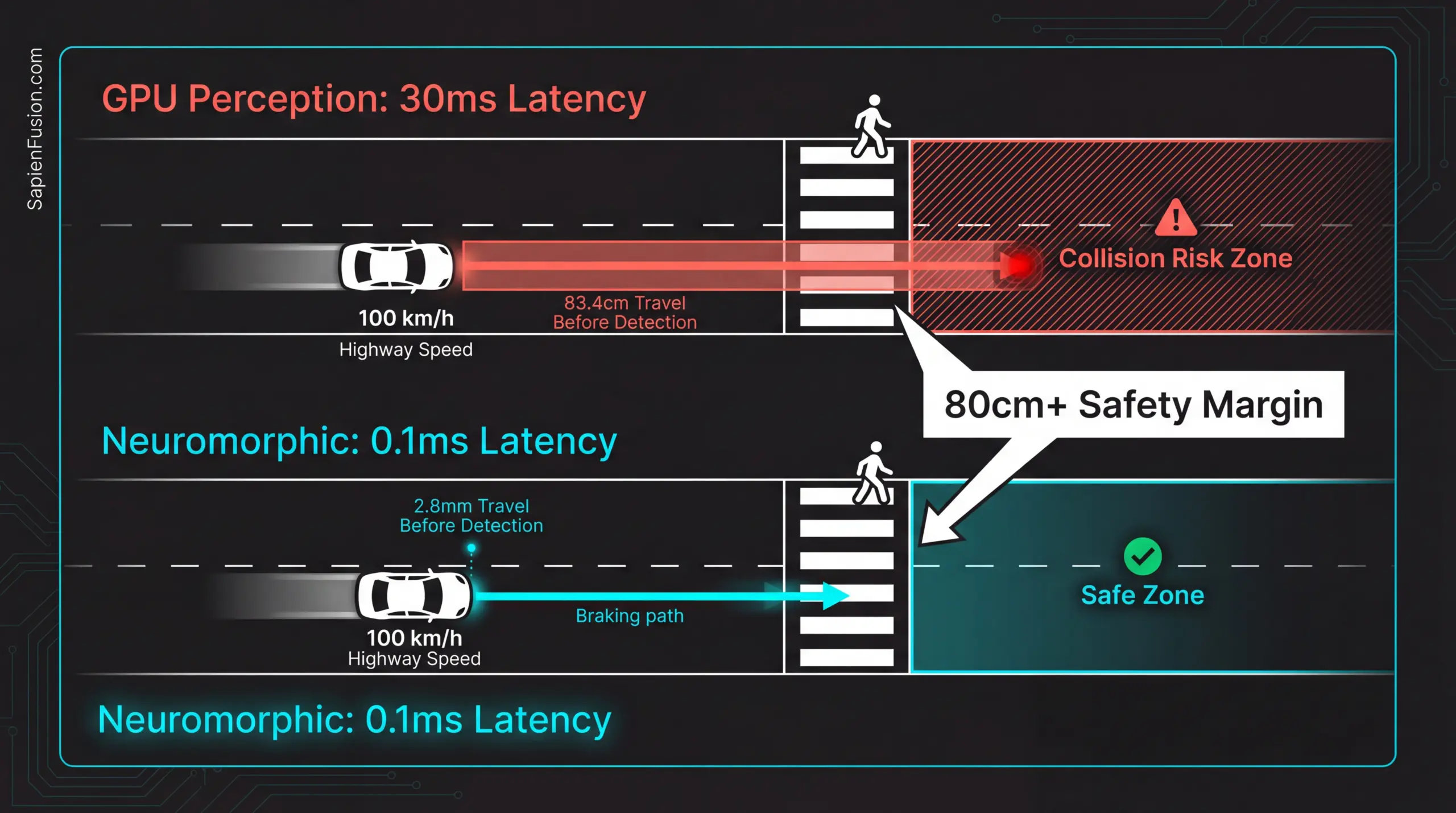

Autonomous and semi-autonomous driving systems face unforgiving physics. At highway speeds, every millisecond of perception latency translates directly to braking distance and collision likelihood. Current GPU-based perception systems achieve 30-50 millisecond latency from sensor input to decision output, acceptable for human-supervised driving but inadequate for higher autonomy levels.

Consider the mathematics. A vehicle traveling 100 kilometers per hour covers 27.8 meters per second. With 30ms perception latency, the vehicle travels 83.4 centimeters before the system registers an obstacle and initiates a response. Add brake system actuation delay, mechanical response time, and physics-limited deceleration rates, and the total stopping distance extends several meters beyond the perception delay alone.

Mercedes-Benz research targeting 0.1ms perception latency reduces pre-detection travel to 2.8 millimeters—essentially instantaneous from a human perspective. This improvement doesn’t merely enhance existing capability. It enables safety margins impossible with conventional architectures, creates a buffer allowing higher-speed autonomous operation, and provides redundancy for system-level fault tolerance.

The regulatory environment amplifies these advantages. Autonomous vehicle certification increasingly focuses on worst-case response scenarios rather than average performance. Certification authorities evaluate maximum perception latency under adverse conditions, not typical latency under ideal circumstances. Neuromorphic systems with sub-millisecond response provide measurable safety margins that simplify regulatory approval and reduce liability exposure.

The Energy Equation

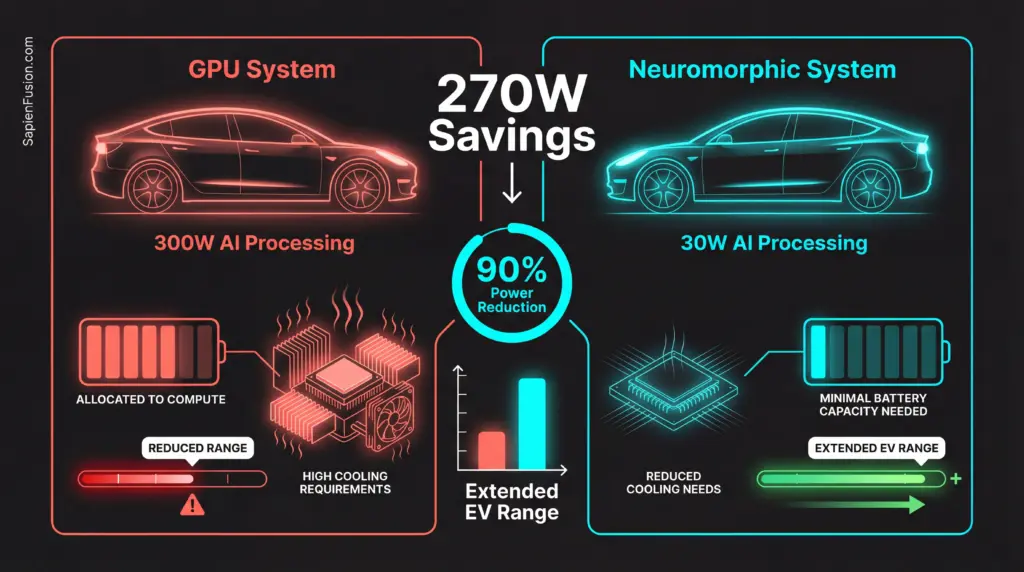

Modern vehicles dedicate substantial power budgets to AI processing. High-performance autonomous driving systems consume 300-500 watts for perception and decision-making—power drawn from either the powertrain battery, reducing vehicle range, or auxiliary power systems, adding weight and cost. Electric vehicles face particularly acute tradeoffs between computational capability and driving range.

Mercedes-Benz targets 90% power reduction through neuromorphic integration, from approximately 300 watts to 30 watts for equivalent perception capability. This reduction translates directly to extended electric vehicle range, reduced cooling system requirements, decreased battery capacity needs for auxiliary systems, and lower thermal management complexity.

The economic implications compound through vehicle lifetime. A 270-watt reduction operating 2 hours daily over a 10-year vehicle lifetime saves approximately 2,000 kilowatt-hours. At average electricity costs, this represents hundreds of dollars in operational savings per vehicle. Multiplied across production volumes reaching hundreds of thousands of vehicles annually, the aggregate impact reaches tens of millions in customer value creation.

Beyond direct energy savings, the reduced power consumption enables deployment scenarios previously infeasible. Vehicles can maintain full perception capability while parked without depleting batteries, operate sophisticated monitoring systems during extended idle periods, and provide continuous security surveillance without range anxiety.

The Integration Challenge

Automotive manufacturers don’t adopt new processing architectures lightly. Vehicle electronics must meet stringent reliability requirements, including decade-long operational lifetimes, operation across temperature extremes from -40°C to +85°C, resistance to vibration and mechanical shock, and tolerance for electromagnetic interference from vehicle electrical systems.

Mercedes-Benz and BMW committed substantial engineering resources to neuromorphic integration despite these challenges. The development process required extensive validation, including thermal cycling testing,g verifying operation across temperature ranges, vibration testing simulating decades of road conditions, electromagnetic compatibility testing ensuring interference immunity, and safety certification demonstrating fault tolerance and graceful degradation.

The software integration proved equally demanding. Automotive perception systems evolved over decades around frame-based processing paradigms. Sensor fusion algorithms expect synchronized data from multiple cameras arriving at fixed intervals. Planning algorithms anticipate predictable computation times for real-time guarantees. Safety monitoring systems require deterministic behavior for fault detection.

Neuromorphic processors operate fundamentally differently. Event-driven computation produces asynchronous outputs rather than synchronized frames. Variable processing latency depends on scene complexity rather than fixed computation schedules. Temporal dynamics introduce state dependencies absent in stateless frame processing.

Mercedes-Benz and BMW engineering teams redesigned perception pipelines, accommodating these architectural differences while maintaining safety guarantees and regulatory compliance. The development effort spanned multiple years, involving hundreds of engineers across perception, planning, control, and safety domains.

The Production Timeline

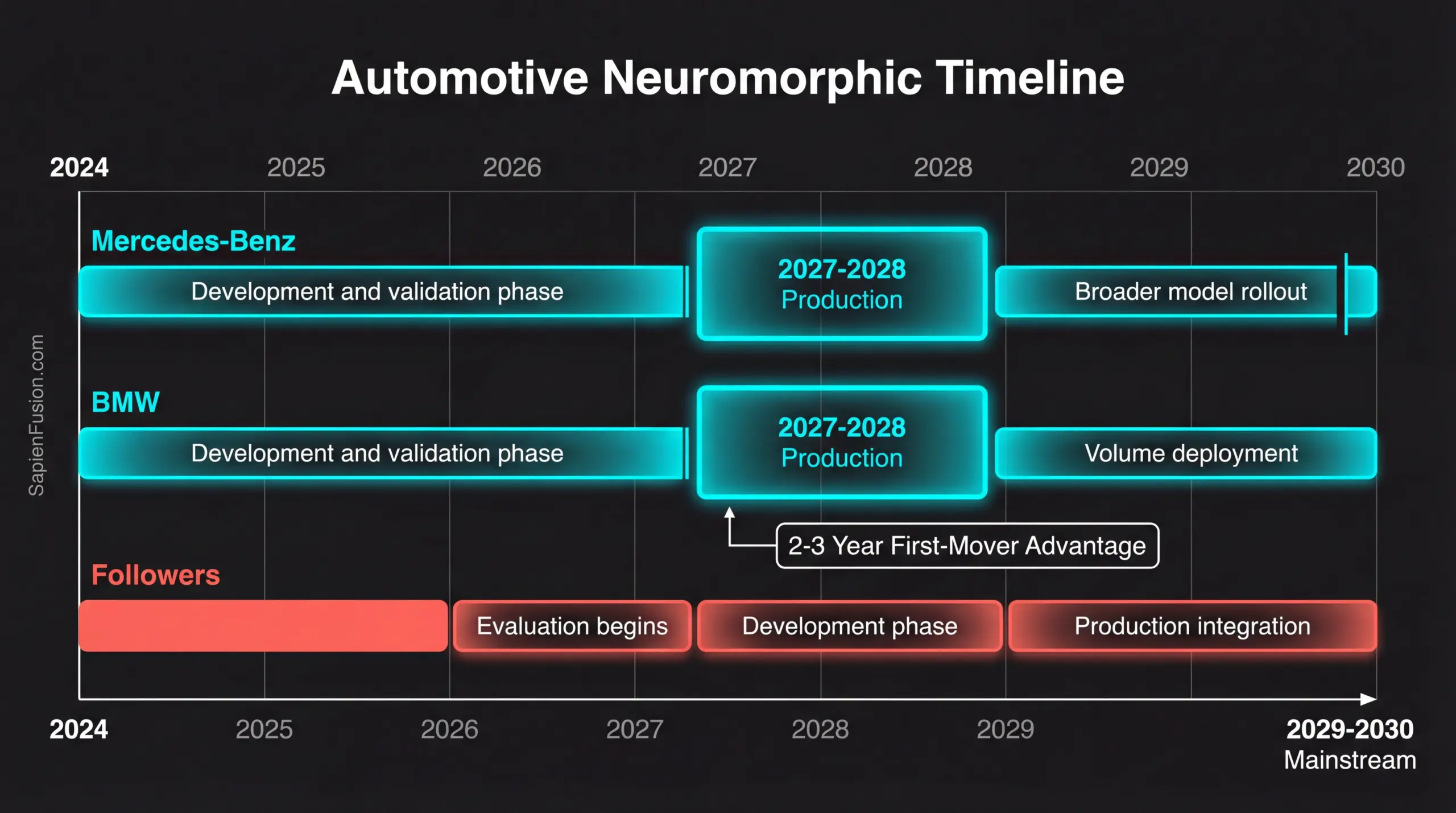

Mercedes-Benz targets initial neuromorphic integration in production vehicles for the 2027-2028 model years. This timeline reflects the automotive industry’s extended development and certification processes rather than technology maturity concerns. New sensing and processing architectures require comprehensive validation before production deployment.

The integration will initially appear in flagship models offering advanced driver assistance features, providing real-world data collection and validation before broader rollout. Early deployments focus on specific perception tasks where neuromorphic advantages prove most significant—pedestrian detection requiring sub-millisecond response, parking assistance needing extreme energy efficiency, and surround-view monitoring benefiting from event-driven processing.

BMW follows a similar timeline with a comparable deployment strategy. Both manufacturers position neuromorphic integration as a competitive differentiator for premium vehicles before cascading technology to higher-volume segments.

The staged approach serves multiple purposes. It limits initial exposure while technology proves itself in customer hands, generates operational data informing subsequent optimization, demonstrates safety and reliability to regulatory authorities, and builds internal expertise before large-scale deployment.

The Competitive Dynamics

Mercedes-Benz and BMW’s neuromorphic commitments force competitive response across the automotive industry. Manufacturers cannot ignore efficiency advantages reaching 90% or safety improvements enabling sub-millisecond response. Competitive vehicles offering comparable autonomous driving capabilities at higher power consumption or longer latency face marketplace disadvantage.

The announcement triggered evaluation programs at multiple manufacturers. Tesla reportedly initiated a neuromorphic research program in late 2024, though public information remains limited. General Motors partnered with IBM exploring NorthPole integration for Cruise autonomous systems. Toyota established a neuromorphic research collaboration with Intel’s Neuromorphic Research Community.

The competitive dynamic resembles electric vehicle transitions and advanced driver assistance adoption—early movers establish positioning and expertise, followers scramble to achieve parity, and laggards face market share pressure. The timeline favors organizations beginning development now rather than waiting for ecosystem maturity.

The Supply Chain Evolution

Automotive manufacturers’ neuromorphic adoption triggers supply chain transformation. Tier 1 automotive suppliers, including Bosch, Continental, and Aptiv, launched neuromorphic integration programs, developing perception modules, sensor fusion systems, and domain controllers incorporating neuromorphic processors.

The supply chain evolution follows predictable patterns. Early custom integration specific to premium manufacturers gives way to standardized modules available across the customer base. Reference designs reduce integration complexity and development time. Certification and validation become collaborative rather than manufacturer-specific.

Intel and IBM both established automotive programs supporting this transition. Intel’s Automotive Neuromorphic Solutions group provides reference designs, development tools, and certification support for Loihi 3 integration. IBM’s automotive partnerships focus on NorthPole deployment in centralized compute architectures.

The supply chain development compresses integration timelines for followers. While Mercedes-Benz required multi-year custom development, manufacturers beginning integration in 2026-2027 access proven designs, validated software stacks, and established certification precedents.

Beyond Perception

Automotive manufacturers envision neuromorphic applications extending beyond perception. In-cabin monitoring systems tracking driver attention, passenger comfort, and occupant safety benefit from event-driven efficiency—continuous monitoring without battery drain. Predictive maintenance systems, analyzing vibration, acoustic, and thermal signatures, identify component degradation through always-on monitoring impossible with conventional processors. Vehicle-to-vehicle communication processing time-critical safety messages achieves sub-millisecond response, enabling coordinated maneuvers.

These secondary applications compound the value proposition. Initial integration for perception capabilities establishes the architectural foundation, expertise, and supplier relationships, enabling rapid expansion to adjacent use cases. The marginal cost of additional neuromorphic applications decreases substantially after initial deployment.

The Strategic Calculation

Mercedes-Benz and BMW’s neuromorphic investments represent calculated bets on architectural transition. The manufacturers evaluated technology maturity, integration complexity, competitive dynamics, and market positioning before committing.

The decision factors included demonstrated efficiency advantages exceeding 10× in relevant workloads, proven reliability through extensive testing and validation, competitive pressure from advancing autonomous capabilities, and a regulatory environment favoring improved safety margins.

The risks they accepted included ecosystem immaturity requiring custom development, a limited supplier base concentrating risk, uncertain customer perception of new technology, and potential for competitive technologies emerging.

The timeline they chose—2027-2028 production deployment—balances being early enough to establish a competitive advantage against being late enough to leverage maturing ecosystems. Organizations following this lead face compressed timelines and increased competitive pressure.

What Automotive Adoption Means

When automotive manufacturers commit to new processing architectures, they signal a technology transition approaching mainstream adoption. The automotive industry’s conservative approach to electronics means Mercedes-Benz and BMW wouldn’t commit without extensive internal validation confirming technology readiness.

Their adoption tells other industries that neuromorphic computing delivers on efficiency promises, meets stringent reliability requirements, integrates successfully despite ecosystem immaturity, and justifies substantial development investment through measurable advantages.

The automotive validation accelerates adoption in adjacent domains. Industrial automation, robotics, and edge AI applications face similar power-latency-reliability constraints that neuromorphic architectures address. Mercedes-Benz and BMW’s success provides a reference case that de-risks adoption decisions in these adjacent markets.

The Inflection Point

The automotive industry’s embrace of neuromorphic computing marks an inflection point in the technology’s evolution. What began as academic research, transitioned through laboratory demonstrations, and proved itself in specialized applications, now enters mass-market production in safety-critical systems.

This transition validates the architectural approach, confirms commercial viability, and establishes market momentum that accelerates ecosystem development, reduces integration costs, and expands the supplier base.

For organizations evaluating neuromorphic adoption, automotive industry validation eliminates uncertainty about technology readiness. The question shifts from whether the technology works to whether they move quickly enough to capture advantages before competitors establish a position.